The Role of Financial Management Applications in Personal Finance

Those who aren’t accustomed to sound financial management methods may find the chore of managing their own personal funds to be somewhat onerous. Technology in today’s world has made budgeting less of a hassle than ever before.

Personal finance applications have made it possible for users to manage their money and keep tabs on their spending, saving, and investing strategies all from the convenience of their smartphones.

The rise in popularity of personal finance applications can be attributed to their usefulness in empowering users with real-time access to detailed information about their financial situations.

Discuss the value of personal financial management software in assisting with budgeting and other aspects of money management.

What Is Personal Finance Management

Managing one’s own money is called “personal finance management,” and it’s the key to both financial security and success. Managing one’s finances properly entails making educated choices about allocating one’s income and spending, dealing with debt, saving, and investing.

An individual’s ability to manage their own money depends on their familiarity with fundamental financial principles including budgeting, saving, investing, and borrowing.

Good spending habits, such as keeping a spending log, making and sticking to a budget, and setting and regularly reviewing achievable financial objectives, are also necessary.

Budgeting, saving, investing, and debt management are just a few of the areas that go under the umbrella term “personal finance management.”

Why Personal Finance Management is so Important

Organizing one’s own finances is crucial for several reasons. Some of the most compelling arguments in favor of good financial planning include the following:

- Achieving financial goals: Successful handling of one’s own finances can pave the way to monetary independence. Having a strategy and making educated decisions may help people move closer to their financial objectives more quickly, whether that’s purchasing a home, paying off debt, or saving for retirement.

- Financial stability: Individuals who take charge of their finances are more likely to reach financial security. Overspending and debt accumulation may be avoided with careful cost tracking, budgeting, and debt management. As a result, this can ease their financial burdens and bring them closer to financial security.

- Building wealth: With proper planning and administration, anyone may increase their net worth over time. A person’s net worth may be increased and financial independence can be achieved via prudent investment, savings, and debt management.

- Making informed decisions: Making wise financial choices is an integral part of personal finance management. Individuals may move closer to their financial objectives by gaining a grasp of budgeting, saving, investing, and borrowing.

- Avoiding financial mistakes: People who take charge of their personal finances often make fewer blunders in that area. Overspending, amassing debt, and other financially damaging blunders can be avoided with careful cost tracking, budgeting, and debt management.

If you want to be financially secure, increase your wealth, and make smart choices about your money, then you need to learn how to handle your personal finances. It has the potential to alleviate stress and help people save money and build wealth.

Types of Personal Finance Apps

There are various types of personal finance apps available to help individuals manage their finances. Here are some of the most common types of personal finance apps:

- Budgeting apps: Individuals may better plan for the future by using the data provided by budgeting applications. These programs might be useful for figuring out where your money is going and when to pay it less.

- Investment apps: Stocks, bonds, and other assets may now be purchased and sold using mobile app trading platforms. To further assist users in making educated investing decisions, several applications also provide research and analytical capabilities.

- Debt management apps: Credit card debt, loan payments, and mortgages are just some of the types of debt that may be managed with the aid of debt management applications. Using these apps, people can organize their debts and monitor their progress toward paying them off.

- Retirement planning apps: An individual’s retirement income may be estimated, their retirement savings needs can be calculated, and they can receive tailored retirement planning guidance with the use of a retirement planning app.

- Tax preparation apps: Tax filing is made easier with the aid of tax preparation applications. With the aid of these applications, taxpayers may optimize their tax benefits and deductions and file their returns with confidence.

Expense tracking, budgeting, debt management, retirement and investment planning are just some of the areas where personal financial applications may be useful.

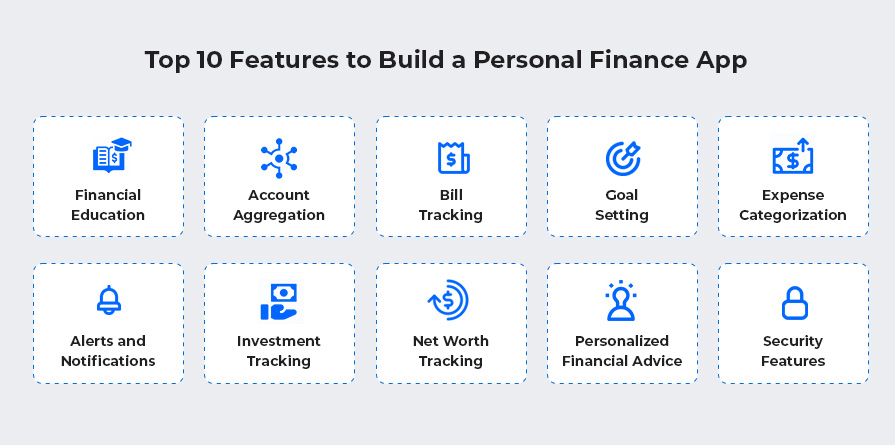

Top 10 Features to Build a Personal Finance App

Here are ten features you should think about including in your personal finance app if you’re planning on making one.

Here are ten features you should think about including in your personal finance app if you’re planning on making one.

- Financial Education: Helping users become more financially literate is a primary goal of financial education. The app has to provide users with financial education tools including articles, videos, and tutorials so they can learn about money and make more informed decisions.

- Account aggregation: Financial accounts including checking, savings, and investment accounts can be linked to the app using the account aggregation function. Users may access all of their financial data in one convenient location with this feature.

- Bill tracking: Bill tracking is a tool that reminds users of upcoming bill due dates and totals owing. A missing payment or late fees won’t be a problem for users thanks to this function.

- Goal setting: One useful function is the ability to create and monitor personal financial objectives. Users may find it easier to maintain their financial discipline with the aid of this function.

- Expense categorization: Expense categorization is a function that classifies users’ expenditures into predefined buckets, such as “food and drink,” “travel and recreation,” and so on. Users may gain insight into their spending habits and discover where they can make reductions with the use of this function.

- Alerts and notifications: Users may set up alerts and notifications for things like overdue payments, low account balances, and potentially fraudulent activities. Users may better manage their money and protect themselves against scams with the use of these tools.

- Investment tracking: Users may keep tabs on their stocks, bonds, and mutual funds with the help of an investment tracking function. Users will find this function useful for keeping tabs on their investments and making educated selections.

- Net worth tracking: Users’ net worth may be determined using the net worth tracking function by deducting their obligations from their assets. Users may get a better picture of their financial standing and monitor their development over time using this function.

- Personalized financial advice: The term “personalized financial advice” refers to a service that tailors its suggestions to each user’s individual needs and objectives. Users may save time and effort by getting more accurate information before making any major financial decisions.

- Security features: Any app that deals with one’s finances should have robust security features. Biometric authentication methods, such as fingerprint or facial recognition, and two-factor authentication are also included. With these safeguards in place, consumers’ private financial data is less likely to fall into the wrong hands.

You may make a strong tool for users to manage their finances, reach their objectives, and enhance their financial well-being by including these 10 elements in your personal finance app.

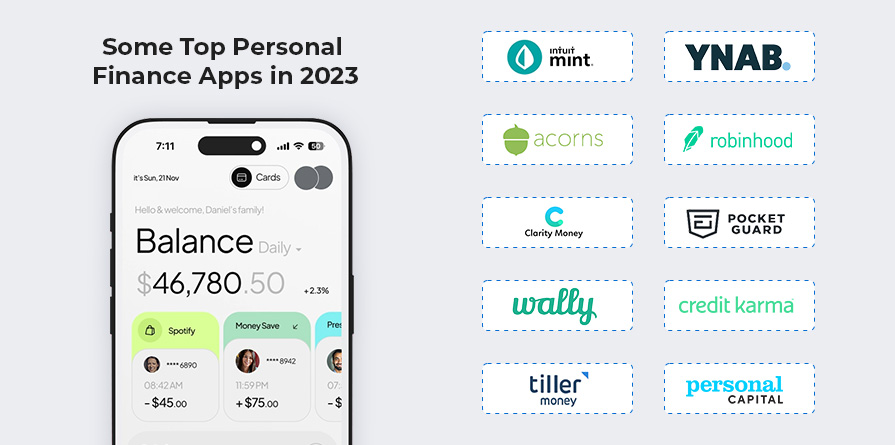

Some Top Personal Finance Apps in 2023

As of the year 2023, the following are some of the best personal financial applications that everyone may use:

- Mint: The Mint software allows users to keep tabs on their credit score, manage their money, and keep track of their spending habits for free. Users may also connect their various accounts and assets to get a holistic view of their financial situation.

- Personal Capital: Personal Capital is an all-inclusive software for managing one’s financial life, including features like budgeting, investment tracking, and a net worth tracker. It also has retirement calculators and investing guidance.

- YNAB: You Need a Budget (YNAB) is a budgeting tool that facilitates the establishment and maintenance of financial budgets. It gives consumers real-time data on expenditure and lets them establish financial targets.

- Acorns: Acorns is a mobile application that facilitates the investing of small amounts of money. The spare change from purchases is added to an exchange-traded fund (ETF) portfolio.

- Robinhood: Robinhood is a mobile investment platform that eliminates brokerage fees on stock trades, ETFs, and cryptocurrency exchanges. Market statistics and news are also available in real time.

- Clarity Money: Money management is made easier using Clarity Money, a personal financial software that allows users to keep tabs on their spending, make a budget, and find places where they can cut costs. Customers can cancel memberships and make payments.

- PocketGuard: As a budgeting tool, PocketGuard may be used to keep tabs on monthly expenses and payments. It offers tips and warnings according to your spending habits.

- Wally: Wally is a budgeting tool that allows users to keep tabs on their finances and expenses in one convenient place. It also has a receipt-scanning feature for easy budgeting.

- Credit Karma: Users of Credit Karma, a free app for monitoring credit, may keep tabs on their credit score and report and get tailored financial guidance. It also offers free help filing your taxes.

- Tiller Money: Tiller Money is a budgeting program that lets you keep tabs on your cash flow, set savings goals, and track your wealth. In addition, it offers adaptable spreadsheets for detailed budgeting and planning.

The best personal finance apps provide useful resources for budgeting, saving, investing, paying off debt, and managing other financial aspects of everyday life.

Cost to Build a Personal Finance App

Personal finance app development costs can fluctuate widely based on a number of variables, including app complexity, features desired, technology employed, and the location and expertise level of the development team. The price of creating a financial management application may be affected by the following:

- Features: The features and capabilities of an app are a major factor in its overall cost. The greater the complexity of the features, the more expensive they are to create. Features like account aggregation, budget tracking, investment tracking, and bill payment, for example, might add to the price of an app.

- Design: Having a well-designed app is important for gaining and keeping users. Engaged and loyal users are easier to keep thanks to a well-designed software. A user-friendly and well-designed software, however, doesn’t come cheap.

- Development Team: The location and expertise of the development team might also affect the total cost of app creation. Developers have a wide range of hourly rates. The hourly rate of a developer in the United States or Europe, for instance, is significantly greater than the rate of a developer in Asia.

- Technology Stack: The cost of creating an app can also be affected by the technological stack that was employed. The price tag on various technologies varies. Creating an app in Swift for iOS might end up costing more than creating the same app in Java for Android.

A personal financial app can cost anywhere from $50,000 to $200,000 or more depending on the above considerations. It’s crucial to remember, though, that the final price tag might change based on the specifics of your app. An experienced development team should be consulted for an accurate cost estimate while creating a personal financial app.

Conclusion

The use of mobile apps to handle one’s finances has revolutionized that process. These programs give customers a holistic view of their financial situation by facilitating expense management, budgeting, and investment tracking in real time.

The importance of personal financial software cannot be overstated when it comes to fiscal management. Designing a secure and intuitive personal finance software is a tall order.

Developers may cater to the needs of their intended users by incorporating these features. Work with a seasoned development group to get an accurate estimate. Financial goal achievement is facilitated by personal finance applications.